The Ad Spend

The agentic intelligence layer for paid advertising.

Each layer compounds on the last. This isn't a point solution — it's a flywheel.

I didn’t research this problem. I lived it.

Enterprise SaaS

Sr. Manager, Digital Marketing at RingCentral. Managed large-scale paid campaigns across platforms. Started learning HubSpot on the side to help friends with their passion projects.

Agency

Got so much HubSpot work it became the business. Founded The Matchbox. ~25 people, 40+ clients, millions in managed spend. Bootstrapped. Hired by companies like Canva and Siemens within 18 months.

HubSpot Partner

90% of agency clients ran on HubSpot, or we pushed them towards it. Dozens of implementations, audits, fixes, and upsells — SMBs to enterprise. The intro to this room came through a HubSpot customer we served.

Product

Built internal tools to solve the problem for our own team. Clients started asking for access. The Ad Spend was born. A decade of hands-on expertise, codified.

Built The Matchbox to millions in managed ad spend for Fortune 500 clients, zero external capital. TEDx speaker on AI in advertising. BA Economics, University of San Francisco.

Founding engineer at startup acquired by Noona (2021). Generated $120K+ ARR while reducing deployment times 98%. Built AI tools processing $300M in political data for UK transparency initiatives. BSc Computer Science (AI/ML), Heriot-Watt University.

Open-source IC at Vercel — ported Turborepo to Rust. Contracted at Meta on Buck2 open-sourcing. Maintains Stripe’s leading Rust API library (async-stripe) — $3K/mo in Stripe sponsorships, 1.9M+ downloads. Built HubSpot integrations for a prior company running entirely on HubSpot’s pipeline and deal management. First Class Honours BSc Computer Science (90%+ avg, University Prize), Heriot-Watt University.

Everyone who touches ad spend is flying blind.

Everyone who touches ad spend is stuck waiting. Waiting for reports. Waiting for someone to explain the “why.” And when the person who knows leaves — the knowledge walks out with them.

The B2B marketing team that just lost their best media buyer

No institutional record of what changed or whether it helped. The new hire starts from zero.

$25K–$32K/yr in lost productivity per marketer

The agency managing 20 accounts with 3 people

Hours building reports for stakeholders who all need different views. Gap between knowing and doing is too wide.

Only 20% of CMOs say they can accurately measure ROI

The growing SMB running its own ads for the first time

Can’t query ad data without logging into multiple platforms. Problems surface too late.

Only 36.5% of global ad spend reaches the right target market

This isn’t a data problem. It’s a context problem. Most decisions are gut feelings. The C-suite gets handpicked numbers and a story they can’t verify.

Association of National Advertisers (ANA), Q2 2025 · Gartner 2025 CMO Spend Survey

The market doesn’t need another dashboard. It needs an agentic intelligence layer.

Optimization without analytics is guessing. Attribution without change history is correlation. Creative without intent data is spray and pray. Each layer requires the data from the layer before it. Point solutions stall because they don't own the data from the stages around them.

Understand

Visibility & causal intelligence

Optimize

Autonomous budget & bid optimization

Attribute

Revenue attribution tied to specific decisions

Predict

Cross-customer intent signals

Automate

AI creative that closes the loop

We built the data foundation first. Content generation comes last, not first. Intelligence layer first. Creative is the capstone.

Marketing needs it. Finance trusts it. Sales can ask it. Leadership finally gets it.

The first stage of the flywheel — live, in production, across our beta of 100+ companies.

15-second install. Slack SSO → account created → ad platforms connected → under 30 seconds to value.

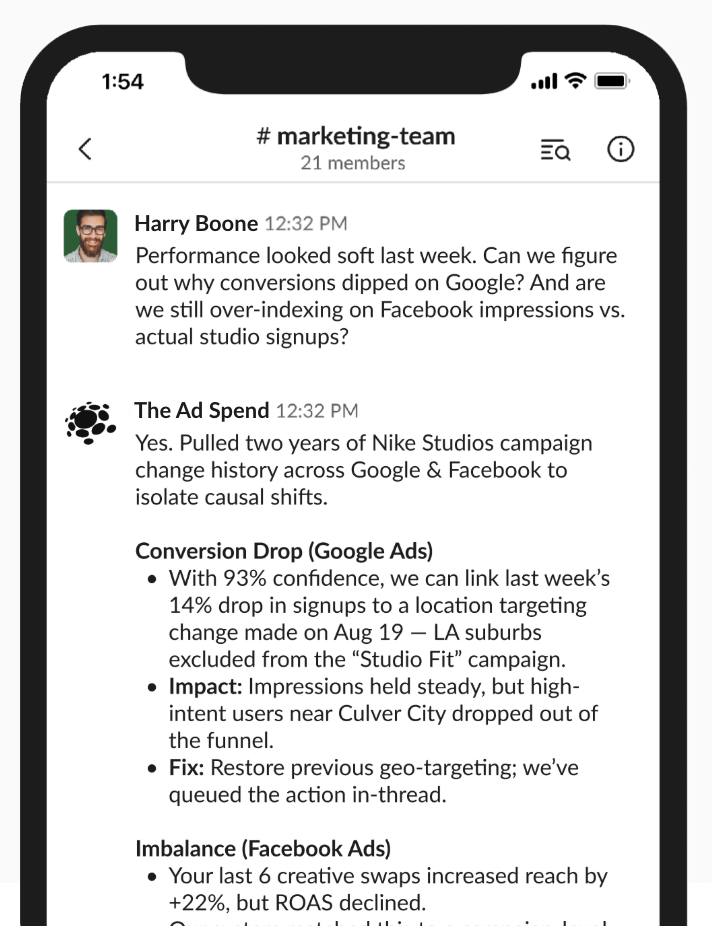

Instant Slack-Native Intelligence

Connect your ad accounts once. The entire team gets real-time alerts, commands, and reporting directly in Slack — no logins, no dashboards, no seat licenses.

AI Trend & Anomaly Detection

160+ detection algorithms running 24/7. Spend spikes, creative fatigue, pacing failures, disapproved ads — surfaced in real time, not last week’s report.

Weekly Custom Stakeholder Rundowns

Automated reports tailored by role. The CFO gets ROAS. The CMO gets pipeline. The media buyer gets creative performance. No more four spreadsheets of the same data.

Settings Change Attribution Engine

Every campaign change — manual or automated, from any platform — logged, timestamped, and linked to performance impact. Git for your ad accounts.

Coming soon: Conversational AI — query any ad account in plain English. In development, shipping shortly.

100+ companies. $68M+ in ad spend on the platform.

Majority B2B and agency customers. 60%+ either use HubSpot themselves or are agencies running HubSpot on behalf of their clients. All agency clients use HubSpot. Acquired at $14–24 CPA — under $15K total burn.

Interrupt Media

B2B agency. Doubled clients without adding headcount.

“This has fundamentally changed the way we run our business.”

Ben Lack, CEO, Interrupt Media

Pricing that scales with the flywheel.

Each tier unlocks the next layer of intelligence.

Basic visibility. 5 alerts, 5 AI queries.

Full AI insights, anomaly detection, unlimited alerts, stakeholder rundowns.

Brands: $49/mo · Agencies: $39/client (min 2)

Auto-optimizer — budget shifts with human approval. The agentic layer.

+ ad spend feeAttribution engine — connect ad decisions to closed revenue.

+ ad spend fee1 agency = 10–50 accounts

Built-in expansion from agency channel. $39/client, min 2. One agency managing 15 clients = $585/mo recurring at zero acquisition cost.

Three reasons this becomes a platform, not a feature.

Dashboards are Dead

The future belongs to platforms that act, not just report. Every dashboard tool is trying to bolt on AI. None of them can — because their data layer was built for display, not reasoning.

System of Record

By owning the institutional knowledge layer — every decision, every outcome, every causal link — we become the unremovable backbone of the marketing stack. The longer you run on us, the harder it is to leave.

Winner-Take-Most

The first engine to own the causal layer will govern how advertising budgets get deployed. Point solutions can’t compound. Dashboards can’t reason. The winner builds the full stack on one data layer.

The full-cycle flywheel. Built from the data layer up.

Each layer requires the one below it. That’s why nobody has built this — and why it can’t be replicated by bolting features onto a dashboard.

Understand

Visibility, causal intelligence, anomaly detection, institutional knowledge capture.

System of record

Optimize

Autonomous budget & bid optimization with human approval queue.

Economics scale with spend

Attribute

Revenue attribution tied to specific decisions. Deep CRM integration.

Unbreakable switching costs

Predict

Cross-customer intent signals derived from real advertiser behavior — targeting strategies, engagement rates, audience performance. Not degraded cookie-based web pixeling. Intent data flipped on its head.

Network effects

Automate

AI creative execution. Builds, tests, and launches campaigns from attribution + intent data.

Full marketing stack

We started at the bottom — the hardest, most defensible part. Intelligence layer first. Creative is the capstone.

Why starting from analytics is the only way to build this.

Every competitor built for display. We built for reasoning. That's an infrastructure decision, not a feature.

The Data Moat

Deterministic hashing on every campaign setting across Google, Meta, and LinkedIn. The system knows exactly what field changed, from what value, to what value, and when — unified into one normalized, LLM-readable schema.

Platforms store their own change history — but in three incompatible formats, disconnected from each other, and none connecting changes to performance outcomes. We unify all three into one schema and build the causal reasoning layer on top. That normalization can’t be retrofitted.

AI-Native Architecture

One normalized, version-controlled, LLM-optimized schema. Every campaign structure translated into a common data model on ingestion. Not an ETL pipeline bolted onto a reporting layer — a purpose-built intelligence substrate structured for causal reasoning.

Dashboard tools store raw platform JSON in separate silos — fine for rendering charts, useless for cross-platform causal reasoning. Retrofitting this isn’t a feature add. It’s a full infrastructure rebuild.

Compounding Intelligence

160+ specialized anomaly detection algorithms. Domain-specific detectors for spend pacing, creative fatigue, bid drift, audience decay, disapproved ads. Every query, every alert, every approved optimization feeds back into the layer.

Every connected account improves cross-customer pattern recognition. More users = smarter insights for everyone. New entrants start at zero and stay there.

Optimizer

Challenge: Reliable write access to Google + Meta campaign management APIs. Confidence scoring.

Status: API access: live. Approval queue + confidence model: in development. Already collecting training data via Settings Change Attribution.

Attribution

Challenge: Clean mapping between ad touchpoints and CRM contact/deal records. LLM-powered credit assignment (Fluid Touch).

Status: HubSpot + Salesforce integration architecture: designed. Fluid Touch: novel — this is the R&D risk and the defensible IP.

Intent Network

Challenge: Requires enough accounts running Attribution to see statistically significant cross-customer patterns.

Status: Designed into the data layer from day one. Not shippable until attribution reaches critical mass. Honest about that.

Three structural fractures. No competitor can bridge them.

Three types of players. None can build the full stack — because their data layer won't let them.

DTC vs. B2B

with nothing in betweenAttribution has split in two.

DTC tools connect to Shopify purchase events — not CRM pipeline or closed revenue.

B2B tools connect to HubSpot and Salesforce — but start at $2,400+/mo with long implementation cycles.

Nobody serves B2B teams at mid-market pricing.

Single-platform

vs. cross-platform intelligenceOptimization tools are locked to one platform.

Madgicx executes on Meta only — Google is reporting-only.

Albert.ai is cross-platform but requires $50K+/mo and offers zero explainability.

Revealbot is rule-based — it can’t detect patterns that weren’t pre-defined.

The gap: AI-driven, cross-platform optimization with human approval at mid-market pricing is the least covered territory in the entire landscape.

Multiple products

siloed dataFull-stack attempts built multiple surfaces on data models designed for each surface independently.

Triple Whale’s attribution doesn’t inform its anomaly detection.

Optmyzr’s change history is correlational, not causal — and covers Google/Microsoft/Amazon only.

The data exists in silos within the same product. The flywheel can’t turn.

One data layer. Cross-platform. B2B and DTC. Free to $499. No implementation, no seat licenses, 15-second install.

That’s HubSpot’s 228K customers — and nobody is building this for them.

12 — Why HubSpot Ventures

We didn’t build for HubSpot’s ecosystem. We grew up inside it.

Already true

The Matchbox was a HubSpot partner. This intro came through a HubSpot customer we served.

All agency clients ran on HubSpot. 60%+ of current Ad Spend accounts either use HubSpot themselves or are agencies who use HubSpot on behalf of their clients.

CRM integration was on our roadmap before this conversation — attribution needs deal pipeline data. Our CTO has already built HubSpot integrations for a prior company.

Your team has said agentic ad optimization won’t be built natively. We’re building it.

What the check unlocks

Product team access — CRM integration goes from roadmap to shipped faster. Arrows rebuilt a third of its product after Ventures gave them product team access.

Agency channel at scale — Partner Day, INBOUND, full solutions partner network. Programmatic distribution, not one-at-a-time.

Signal value — for a PLG tool, HubSpot Ventures on the cap table tells every B2B marketer in the ecosystem this is the endorsed solution.

Series A positioning — HubSpot Ventures + top-tier VC lead = ideal cap table for a company building the ad intelligence layer for B2B.

Dharmesh recently wrote that every successful GTM agent needs an agentic customer platform. Our optimization agents get smarter with HubSpot CRM context. HubSpot’s Breeze agents get smarter with ad intelligence signals. As attribution matures, the ad intelligence we generate becomes a natural extension of Breeze Intelligence — the same way Clearbit’s data became core to the platform. Your team tracks a $5‑to‑$1 ecosystem multiplier. We’re built to generate it.

$2M to go from beta to Series A with three revenue layers live.

100+ companies on the platform. $68M+ in ad spend ingested. 160+ detection algorithms running. Settings Change Attribution collecting training data daily. Optimizer in beta. $2M accelerates what's already working.

100+ beta → ~375 paying customers

PLG conversion rate validated at scale

HubSpot App Marketplace listing live

Optimizer out of beta → generally available

Approval queue + confidence scoring in market

$199/mo + ad spend fee tier activated

Agency multiplier compounding (1 agency = 10–50 accounts)

HubSpot CRM integration in build

Fluid Touch Attribution in early beta with design partners

$499/mo + ad spend fee tier in pilot

2 engineers to take Optimizer GA and begin building Attribution. Every dollar of product spend directly unlocks the next revenue tier.

PLG distribution, agency channel, HubSpot Marketplace launch.

Three founders. Infrastructure. Lean by design.

Three people. 100+ companies. $68M+ in ad spend analyzed. Optimizer in beta. $2M gets us to Series A with two revenue layers proven and attribution underway.

Raising $2M. In active conversations with institutional seed funds and strategic investors. HubSpot Ventures as a strategic co-investor makes the round more attractive to any institutional lead.

Thank you.

ani@theadspend.com